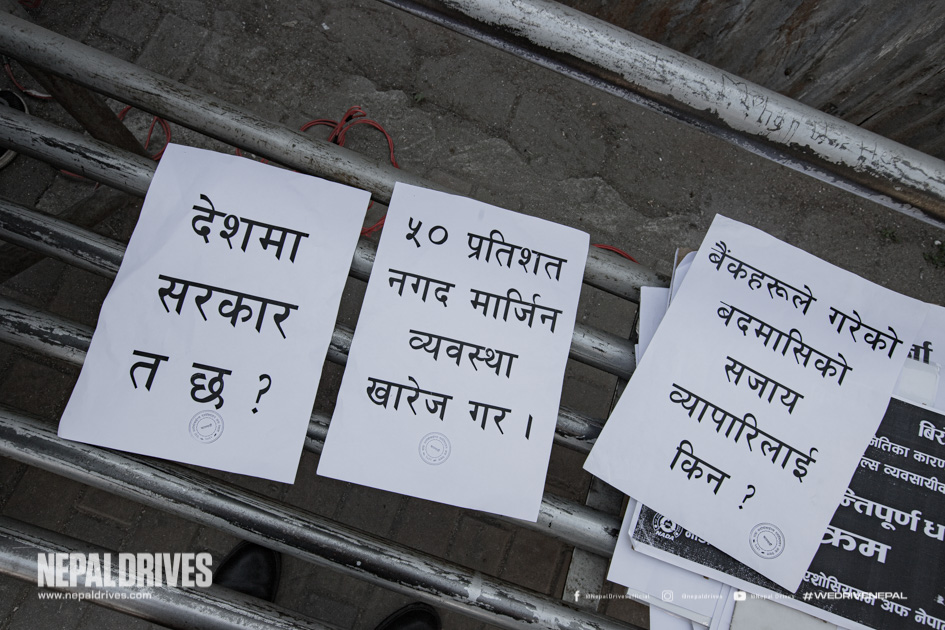

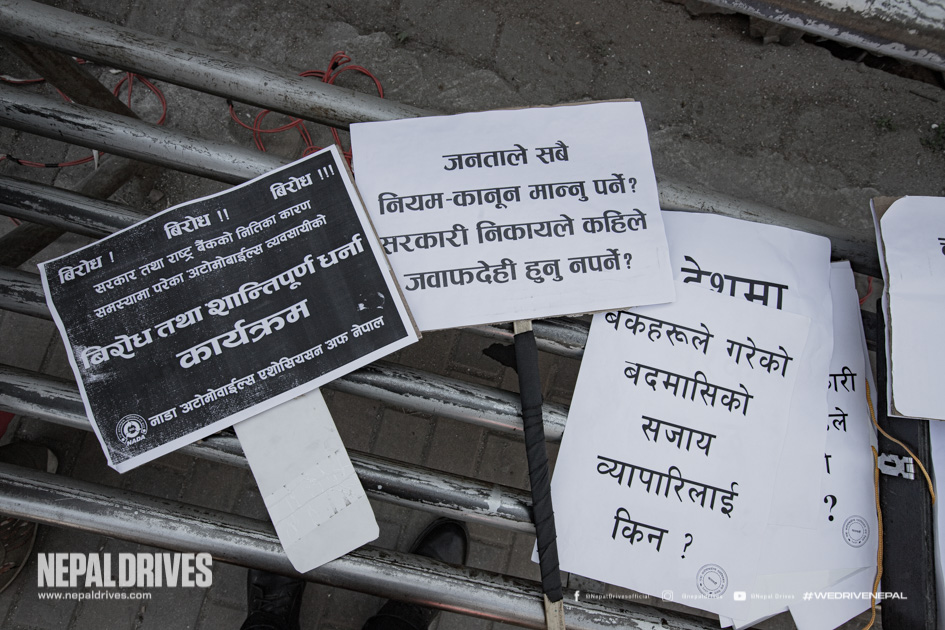

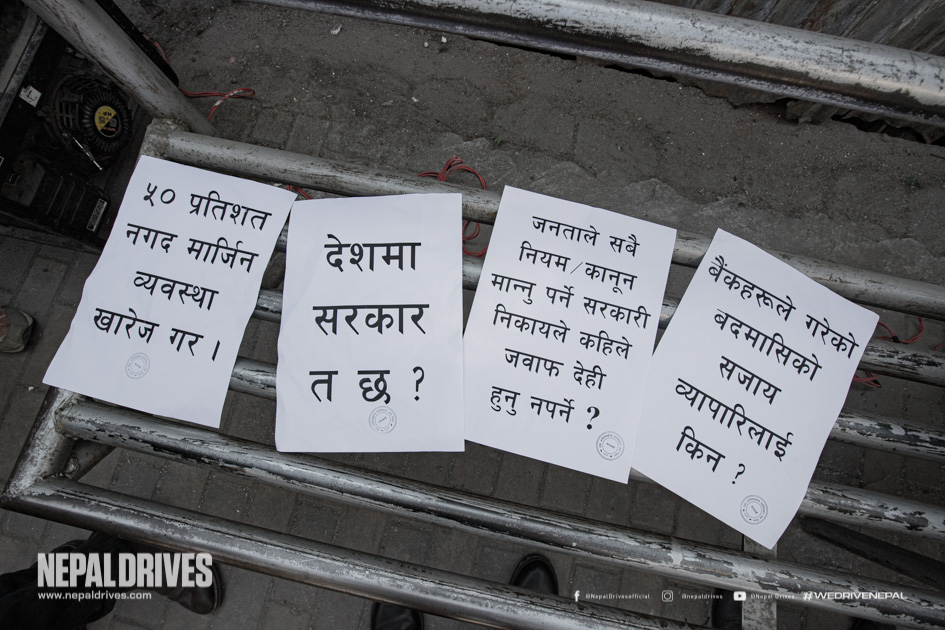

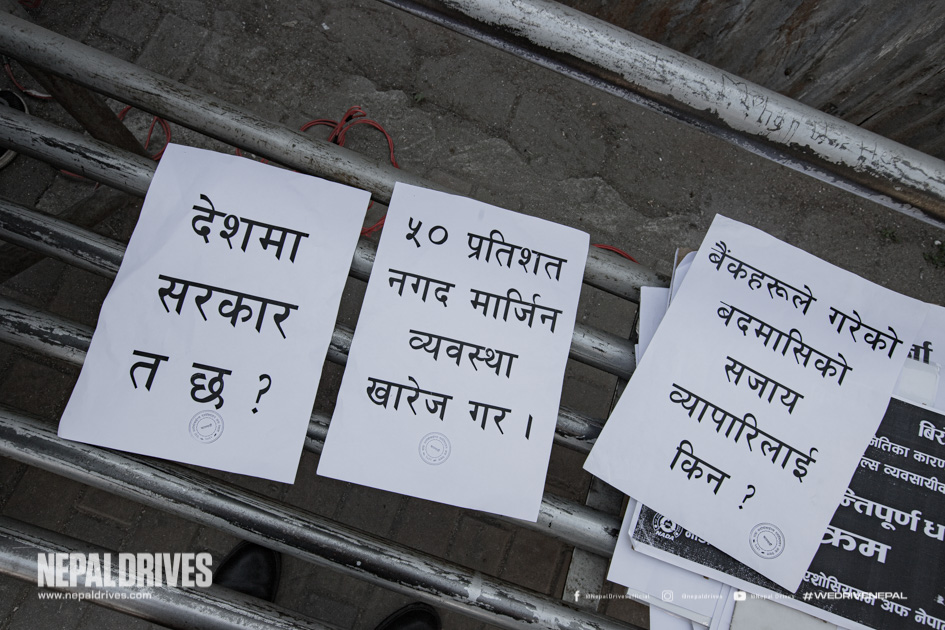

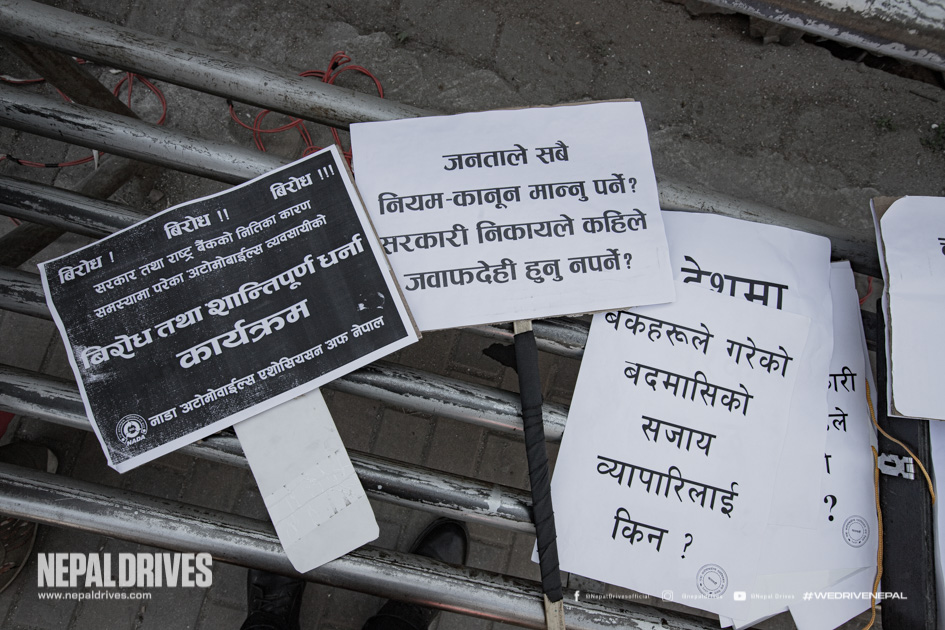

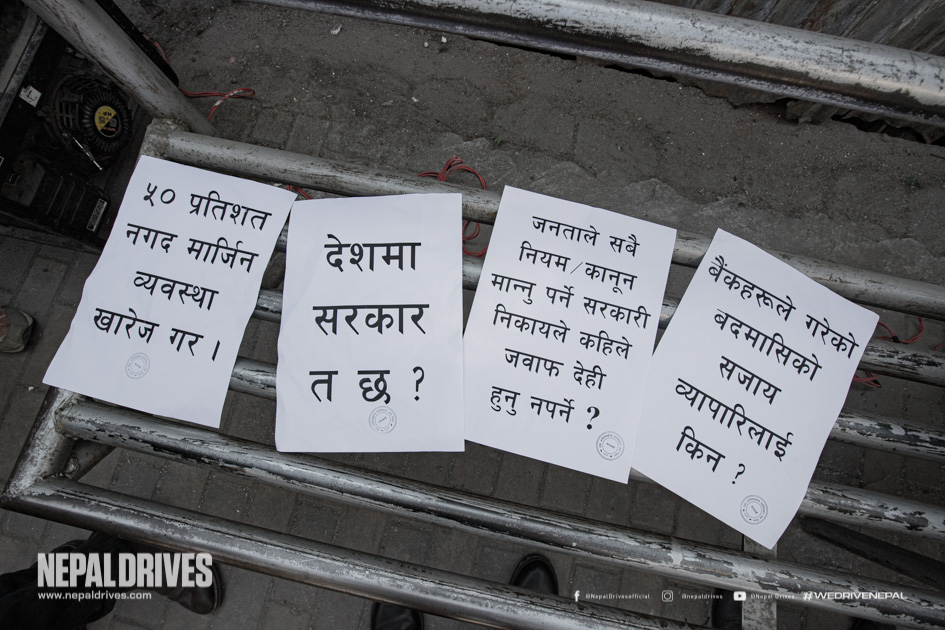

Automobile dealers have staged a protest at Maitighar Mandala today demanding the government roll back the unfavourable policies in matters related to automobile businesses.During the protest organised by NADA Automobiles Association of Nepal (NADA), the umbrella organization of automobile dealers in Nepal, the automobile businessmen warned that the protest will continue until the demands put forward by the dealers are addressed by the government at the earliest. Speaking to the media, Dhruba Thapa, President-NADA, strongly objected to the government's unfavourable policies that may force automobile dealers to pull their shutters down."We welcome the government's decision to lift the import ban. However, the policy changes still remain a huge challenge. Our demands like providing concessions on the interest on the loan of the automobile business, adjustment of risk burden in auto loans, removal of cash margin system while issuing the letter of credit, adjustment in the working capital loan guidelines, and control of high premium rate imposed by banks, have not yet been addressed. Therefore, we have announced this movement to create pressure for that", pointed out Thapa."Increasing the interest rates may compel customers to stay away from purchasing vehicles," another protestor said.The government on Tuesday announced to lift the ban on the import of vehicles imported for private purposes and motorcycles above 150cc after December 15, 2022, however, the policies implemented by the central bank remain a huge roadblock for the Nepalese automobile sector.

Speaking to the media, Dhruba Thapa, President-NADA, strongly objected to the government's unfavourable policies that may force automobile dealers to pull their shutters down."We welcome the government's decision to lift the import ban. However, the policy changes still remain a huge challenge. Our demands like providing concessions on the interest on the loan of the automobile business, adjustment of risk burden in auto loans, removal of cash margin system while issuing the letter of credit, adjustment in the working capital loan guidelines, and control of high premium rate imposed by banks, have not yet been addressed. Therefore, we have announced this movement to create pressure for that", pointed out Thapa."Increasing the interest rates may compel customers to stay away from purchasing vehicles," another protestor said.The government on Tuesday announced to lift the ban on the import of vehicles imported for private purposes and motorcycles above 150cc after December 15, 2022, however, the policies implemented by the central bank remain a huge roadblock for the Nepalese automobile sector.

Speaking to the media, Dhruba Thapa, President-NADA, strongly objected to the government's unfavourable policies that may force automobile dealers to pull their shutters down."We welcome the government's decision to lift the import ban. However, the policy changes still remain a huge challenge. Our demands like providing concessions on the interest on the loan of the automobile business, adjustment of risk burden in auto loans, removal of cash margin system while issuing the letter of credit, adjustment in the working capital loan guidelines, and control of high premium rate imposed by banks, have not yet been addressed. Therefore, we have announced this movement to create pressure for that", pointed out Thapa."Increasing the interest rates may compel customers to stay away from purchasing vehicles," another protestor said.The government on Tuesday announced to lift the ban on the import of vehicles imported for private purposes and motorcycles above 150cc after December 15, 2022, however, the policies implemented by the central bank remain a huge roadblock for the Nepalese automobile sector.

Speaking to the media, Dhruba Thapa, President-NADA, strongly objected to the government's unfavourable policies that may force automobile dealers to pull their shutters down."We welcome the government's decision to lift the import ban. However, the policy changes still remain a huge challenge. Our demands like providing concessions on the interest on the loan of the automobile business, adjustment of risk burden in auto loans, removal of cash margin system while issuing the letter of credit, adjustment in the working capital loan guidelines, and control of high premium rate imposed by banks, have not yet been addressed. Therefore, we have announced this movement to create pressure for that", pointed out Thapa."Increasing the interest rates may compel customers to stay away from purchasing vehicles," another protestor said.The government on Tuesday announced to lift the ban on the import of vehicles imported for private purposes and motorcycles above 150cc after December 15, 2022, however, the policies implemented by the central bank remain a huge roadblock for the Nepalese automobile sector.NADA's demands and suggestions

- The Current Capital Credit Guidelines (2079) issued by Nepal Rastra Bank should be postponed for the time being and should be implemented with the necessary modifications at the appropriate time.

- The provision of issuing a letter of credit (LoC) with a 100% cash margin and 50% cash margin should be scrapped.

- The financial bodies of Nepal have decided to increase the interest rate on loans effective from the 1st of Kartik 2079. This has seriously affected the entire industry and businesses including the automobile sector of Nepal. Hence, necessary arrangements should be made to control the current interest and premium rates immediately.

- The risk weight in auto loan hire purchase loans should be brought down from 150 percent to 75 percent.

- To ease the lack of liquidity of the banks, the CD ratio should be reviewed.

- The payment period for the delivery order after the approval of the hire purchase loan from the banks should be made within a week.

- Similarly, in the process of issuing a loan for private vehicles from the banks, the current limit of the loan amount should be increased to 70 percent from the current 50 percent.

- The deadline for renewal of the full loan should be extended for one year.

- For the revival of the automobile business, which has been stalled for a long time due to covid and the import ban, arrangements should be made for rescheduling loans and special concessions on interest rates.

Published Date: 2022-12-08 20:11:52

Post Comments

Most Read This Week

More Local News